Predrag Vuckovic

Actual Property Weekly Outlook

U.S. fairness markets rebounded this week from their worst weekly decline in a yr regardless of a continued uplift in benchmark rates of interest, as a stable begin to company earnings season counteracted disappointing financial information. Forward of the Fed’s coverage assembly within the week forward, markets had been confounded – albeit briefly – by a “jarring” GDP report that confirmed a return of “stagflationary” developments of weakening progress and sticky inflation in early 2024, a report that possible strengthened the central financial institution’s latest hawkish pivot.

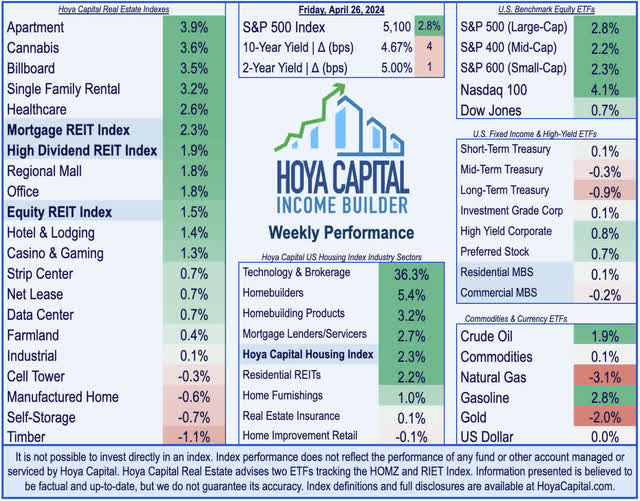

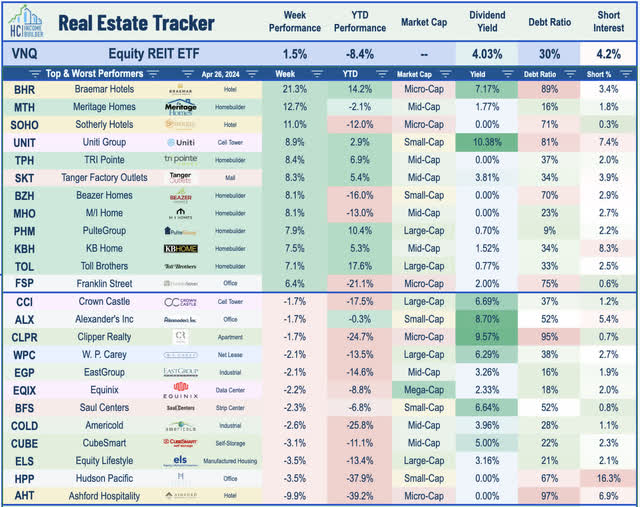

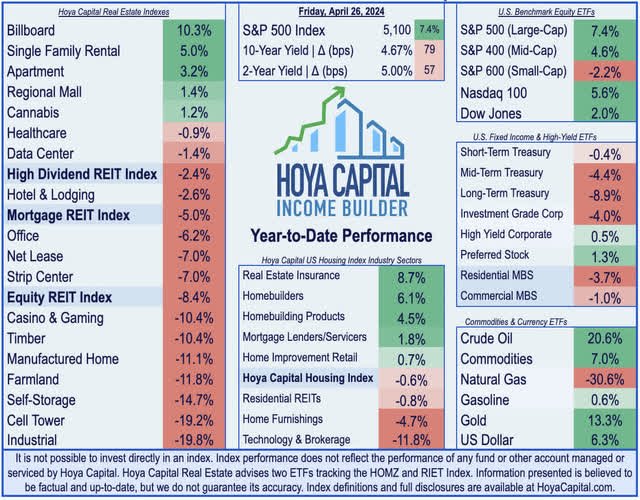

Defying the macro headwinds to put up its greatest week since November, the S&P 500 rallied 2.8% on the week – erasing basically all of its declines within the prior week. Following a plunge of practically 5% final week, mega-cap know-how shares fueled the rebound on the heels of robust AI-generated earnings outcomes from Microsoft and Alphabet, lifting the Nasdaq 100 to positive factors of over 4%. Features had been extra muted for smaller-cap and domestic-focused segments, with the Small-Cap 600 and Mid-Cap 400 every posting positive factors of round 2%. Actual property equities steadied this week following a brutal stretch over the prior two months, as rate of interest headwinds had been offset by a comparatively spectacular slate of earnings experiences from residential and workplace REITs. Recovering after a three-week skid of practically 8%, the Fairness REIT Index superior 1.5% on the week, with 14-of-18 property sectors in optimistic territory, whereas the Mortgage REIT Index superior by 2.3%. Homebuilders and the broader Housing 100 Index additionally posted positive factors of over 2% after housing information and earnings outcomes from a half-dozen builders confirmed slow-but-steady new residence gross sales developments.

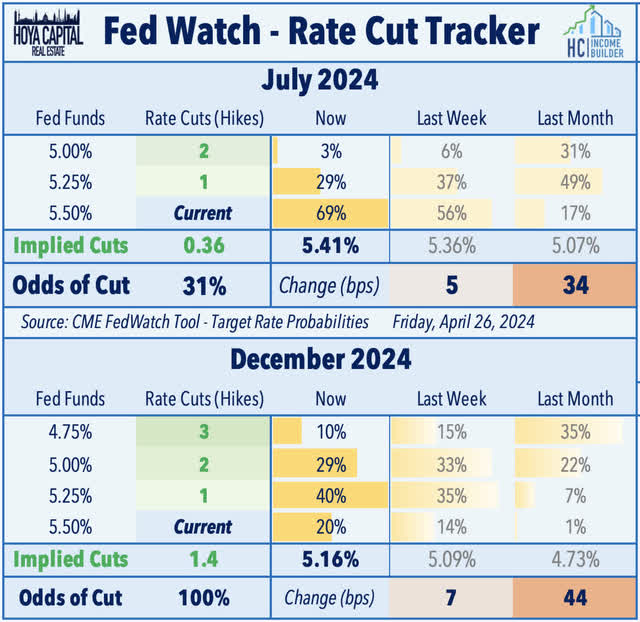

Following a shaky begin to first-quarter earnings season, outcomes over the previous week had been moderately spectacular. Per FactSet, 77% of S&P 500 constituents have reported EPS above consensus estimates – above the 10-year common of 74% – with power that was moderately constant throughout a number of sectors. The blended earnings progress charge for the primary quarter is now 3.5%, up sharply from simply 0.6% final week. Bond buyers had been unimpressed, nonetheless, focusing as an alternative on financial information that appeared to verify the dreaded reacceleration in inflationary pressures in latest months, pushed largely by the continued uplift in oil costs. Swelling to its highest stage since final November, the 10-12 months Treasury Yield rose one other 4 foundation factors on the week to 4.67%, whereas the policy-sensitive 2-12 months Treasury Yield closed the week above 5%. Swaps markets are actually pricing in only a 10% chance that the Fed will minimize charges in June, and simply 31% odds of a July minimize. Markets now count on simply 1.4 charge cuts in 2024 – down from the 1.5 cuts priced in final week, and down sharply from a peak of round 7 cuts earlier this yr.

Actual Property Financial Knowledge

Beneath, we recap crucial macroeconomic information factors over this previous week affecting the residential and business actual property market.

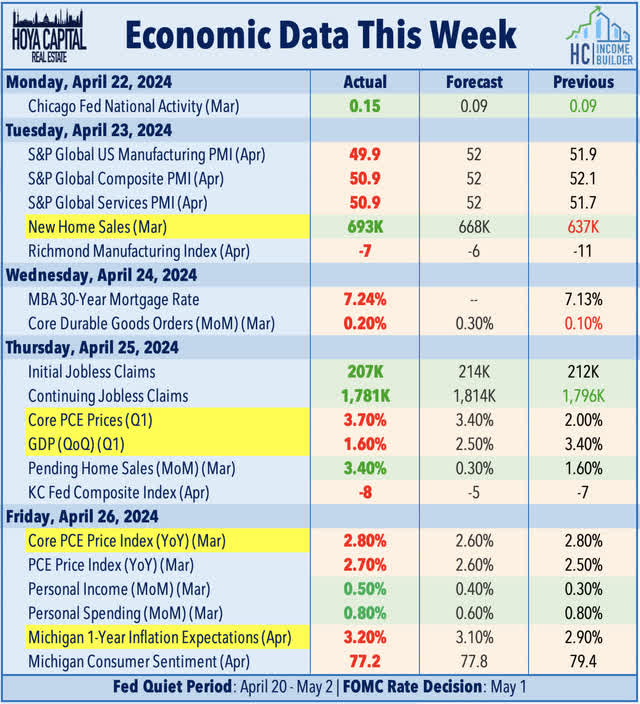

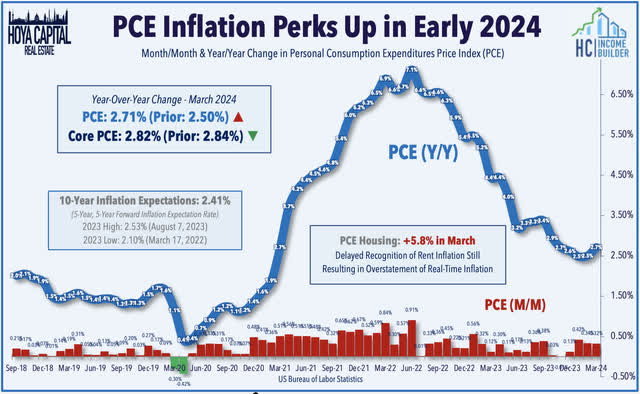

Spurring a return of stagflation fears and additional dimming the outlook for Fed charge cuts, GDP information this week confirmed that U.S. financial progress was far weaker than anticipated whereas inflation accelerated within the first quarter. Actual Gross Home Product elevated at a 1.6% annualized tempo – the slowest tempo because the second quarter of 2022 – whereas the intently watched Core PEC sequence surged at a 3.7% charge within the first quarter, the most well liked quarterly inflation print in a yr. The month-to-month PCE report the next day, nonetheless, confirmed a extra muted uptick in March. Headline PCE elevated by 0.3% in March – matching the unrevised acquire in February – which lifted the year-over-year charge to 2.7% from 2.6% within the prior month. Core PCE rose 0.4% from the prior month and a pair of.8% from a yr earlier. Items costs elevated 0.1% for the month as increased gasoline costs offset declines in automobile costs, whereas providers costs rose 0.4%, a rise that’s nonetheless being pushed largely by the delayed recognition of housing inflation seen 9-18 months in the past. We have famous that real-time shelter inflation – as measured by a half-dozen non-public market information suppliers – is nearer to the 0-2% vary, far under the 5.8% improve reported in authorities information. Substituting the House Checklist Nationwide Lease Index (ALNRI) for the PCE Housing element exhibits that PCE would have posted a roughly 2% annual improve – nonetheless in-line with the Fed’s 2% inflation goal.

Fairness REIT & Homebuilder Week In Evaluation

Finest & Worst Efficiency This Week Throughout the REIT Sector

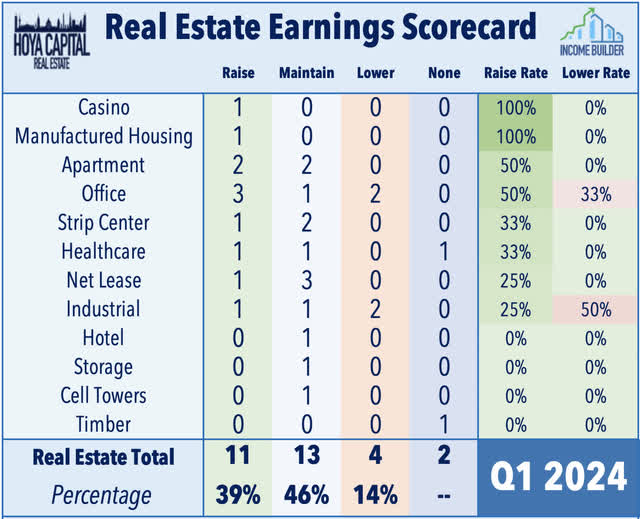

REIT earnings season heated up this week with outcomes from roughly two dozen REITs and a half-dozen homebuilders. In step with most of the developments mentioned in our Earnings Preview, actual property earnings outcomes over the previous week confirmed a shocking firming in residential rents regardless of ample multifamily provide, regular optimistic momentum in retail fundamentals, a notable rebound in workplace leasing exercise, softer leasing developments in goods-oriented property sectors, and an total slowdown in building exercise. We’re now roughly 1 / 4 of the way in which by means of fairness REIT earnings season, with 30 of the roughly 140 fairness REITs now having reported outcomes. Of the 28 REITs that offered up to date steerage, 11 (39%) raised their full-year FFO outlook, 13 (46%) maintained, whereas 4 REITs (14%) lowered their steerage. Beneath, we focus on a few of the highlights from the busy week of earnings experiences throughout the actual property sector.

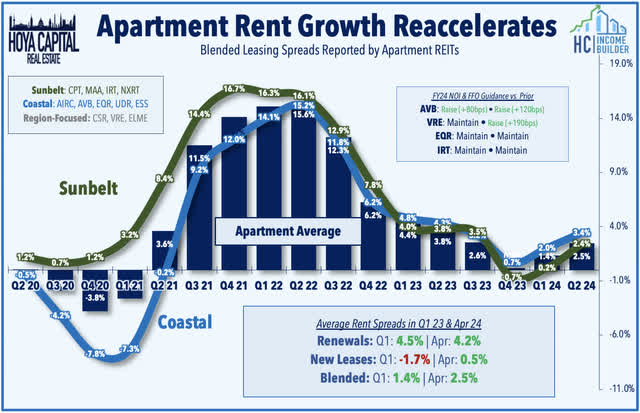

House: Rents are rising, once more. House REITs had been among the many leaders this week after a quartet of multifamily operators reported stable outcomes highlighted by a shocking reacceleration in lease progress following a two-year slowdown. Fairness Residential (EQR) and AvalonBay (AVB) rallied by 6% and 4%, respectively, after their outcomes confirmed strengthening fundamentals in coastal markets, the place provide progress has been extra muted than within the Sunbelt. Notably, AVB raised its full-year outlook throughout the board, pushed by each stronger-than-anticipated income progress and lower-than-anticipated bills. EQR maintained its full-year metrics however recorded an much more distinct related in leasing spreads. EQR famous that blended lease spreads accelerated to 1.6% in Q1 – up from a three-year low of 0.7% in This autumn – and accelerated additional to three.1% so far in Q2. Notably, new lease spreads turned optimistic in early April (+0.1%) after posting two-quarters of declines in This autumn (-4.6%) and Q1 (-2.2%). Renewal spreads have remained firmly optimistic at 4-5% over the previous yr, whereas same-store occupancy charges improved by 50 foundation factors over the previous yr to 96.3% within the first quarter. Independence Realty (IRT) gained 1.5% after reporting in-line outcomes, displaying a barely extra muted reacceleration in Sunbelt markets. IRT maintained its full-year outlook throughout its metrics and famous that blended lease progress rebounded from four-year lows of 0.2% in This autumn to 1.2% in Q1 and 1.8% so far in April. Veris Residential (VRE) – which focuses on the NYC metro – additionally gained 1% after elevating its full-year FFO outlook, citing latest debt discount.

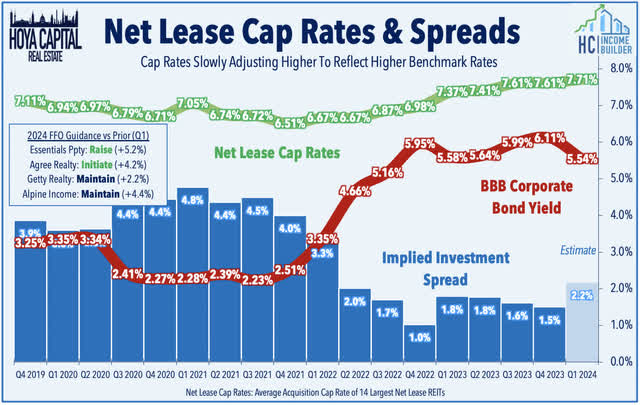

Web Lease: A trio of web lease REITs reported outcomes this week. Agree Realty (ADC) gained 2% after initiating its full-year outlook above Avenue consensus and noting some upward motion in non-public market cap charges, which had remained stubbornly sticky regardless of the surge in benchmark rates of interest over the previous two years. ADC initiated full-year steerage calling for FFO progress of 4.2% – above analyst consensus of two%. Importantly, ADC reported significant upward motion in cap charges and reported a extra deliberate tempo of acquisition motion, noting that it acquired $124M of properties at a 7.7% cap charge, which compares to This autumn exercise of $187M at a 7.2% cap charge. Notably, the 7.7% cap charge in Q1 was the very best on file for ADC, and up notably from the lows of 6.0% in early 2022. Important Properties (EPRT) gained 1% after it reported stable outcomes and raised its full-year FFO outlook to a sector-leading 5.2%, pushed by a surprisingly strong quarter of transactions exercise. EPRT acquired $249M in properties in Q1 – its most energetic first quarter since inception – at an 8.1% cap charge, which compares to its pandemic-era low of 6.9%. Getty Realty (GTY) completed flat after affirming its full-year outlook for FFO progress of two.2%. Not like EPRT, nonetheless, GTY reported a muted quarter of acquisitions, nonetheless, citing “challenges” from broad bid-ask spreads. GTY acquired $41M in properties at a 7.7% cap charge and famous that cap charges have elevated “100 to 125 foundation factors” from pandemic-era lows.

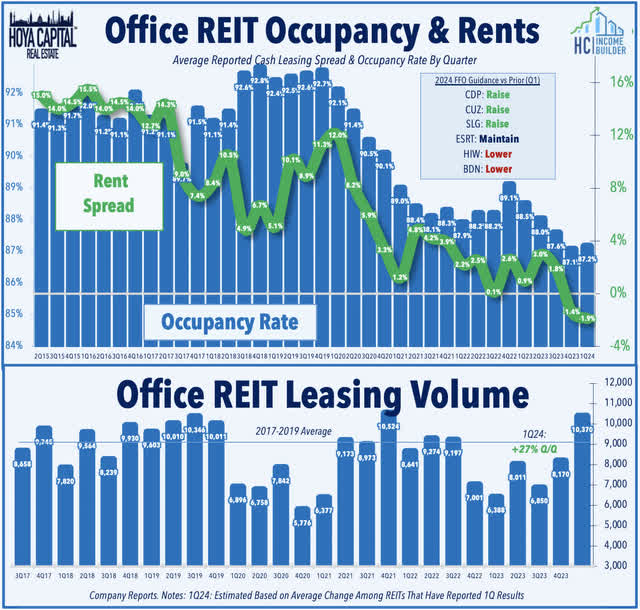

Workplace: The surprisingly robust begin to earnings season for workplace REITs continued this previous week. Following a pair of first rate outcomes final week, a quartet of workplace REITs this week confirmed a equally stable reacceleration in leasing exercise in early 2024. Sunbelt-focused Highwoods (HIW) rallied 6% this week after it reported 922k SF of whole leasing exercise in Q1 – up 32% from the final quarter and roughly even with its pre-pandemic common from 2017-2019. HIW raised its 2024 same-store NOI progress outlook to 1.25% – up from 1.0% final quarter – however trimmed the top-end of its FFO outlook because of increased anticipated curiosity expense. HIW commented “Opposite to in style opinion, we’re seeing robust demand throughout our portfolio,” highlighting power in Tampa, Atlanta, and Raleigh. Cousins Properties (CUZ) – one other Sunbelt REIT – rallied 3% after it reported spectacular 7% NOI progress in Q1, an 80 foundation level enchancment in comparable occupancy, and raised its full-year FFO outlook to +0.6%, which might be 4% above its pre-pandemic 2019 FFO. COPT Protection (CDP) rallied 4% after it additionally raised its full-year outlook to +5.0%, which might be 15% above its 2019 FFO. NYC-focused Empire State Realty (ESRT) gained 1% after additionally reporting a notable enchancment in occupancy and an acceleration in leasing spreads to +4.8% from -2.6% in This autumn. The preliminary six workplace REITs have reported a median sequential acceleration in leasing quantity of 27%, in keeping with latest upbeat information from JLL.

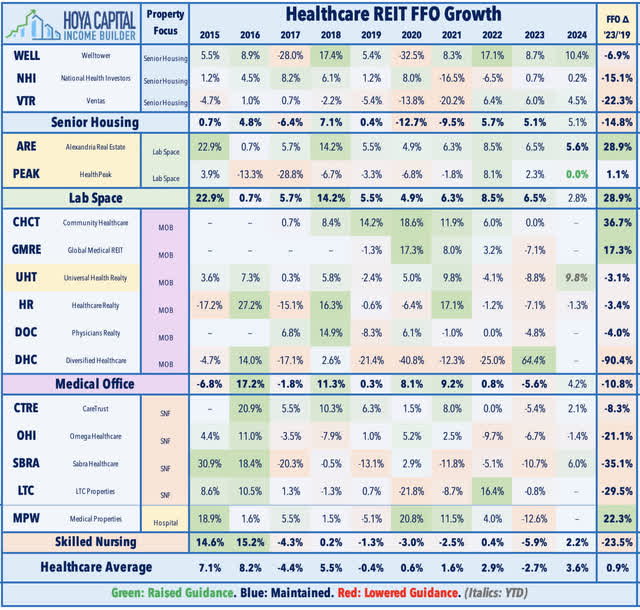

Healthcare: Medical workplace constructing REIT Healthpeak (DOC) rallied practically 5% after reporting stable outcomes, highlighted by progress in synergy realization following the completion of its merger with fellow MOB REIT Physicians Realty final month. DOC now expects to attain $45M in value synergies this yr – up from $40M – pushed primarily by headcount reductions at each the company stage and on the property stage in overlapping markets. DOC raised its full-year FFO outlook, now anticipating flat progress this yr in comparison with its prior forecast of a -1.1% decline. A optimistic read-through for Senior Housing REITs, DOC famous explicit power in its comparatively small senior housing portfolio. This “CCRC” section recorded NOI progress of practically 27% in Q1 pushed by elevated occupancy and charge progress, which drove a rise in DOC’s full-year NOI progress outlook to three.25% on the midpoint. MOB fundamentals remained comparatively stable, with same-store NOI progress of two.6% in Q1 – down barely from the three.4% achieved in full-year 2023. DOC reported stable leasing exercise of practically 1.5M sq. toes, on which it achieved optimistic leasing spreads of three.4%. We have highlighted that MOB REITs had underperformed in early 2024 regardless of indications of comparatively stable fundamentals. JLL’s newest report printed this month concluded, “[MOB] fundamentals stay robust, and building begins stay gradual, positioning medical outpatient buildings for growing occupancy and rental charge progress.”

Sticking within the healthcare area, lab area proprietor Alexandria (ARE) – which has stumbled in latest quarters amid a post-pandemic “normalization” in demand for lab area alongside file ranges of latest provide progress – gained 0.5% this week after reporting stable outcomes and sustaining its full-year outlook calling for FFO progress of 5.6%. Complete leasing exercise accelerated in Q1 to 1.1M SF throughout 1Q24 – up from 890k SF in This autumn, which was its slowest quarter of quantity since Q2 2019. Leasing volumes peaked in Q2 2021 at over 4M SF and totaled over 9M in 2021 however cooled to 4.3M throughout full-year 2023. Leasing spreads additionally improved sequentially, with ARE reaching 19.0% money rental charge will increase in Q1 – up from a multi-year low of 5.5% in This autumn. Whereas nonetheless comparatively stable in comparison with different REIT sectors, money NOI progress cooled to 4.2% in Q1 – down from 4.6% a yr earlier – and ARE maintained its outlook for 4.0% money NOI progress for the full-year. Occupancy was regular in Q1 at 94.6%, whereas tenant lease assortment remained constant at 99.9%. CBRE famous in its latest quarterly Life Sciences report that industry-wide occupancy charges dipped 700 foundation factors final yr to under 87%, ensuing from a record-level of latest provide. CBRE famous, nonetheless, that the development pipeline has began to reasonable whereas web absorption turned optimistic in late 2023.

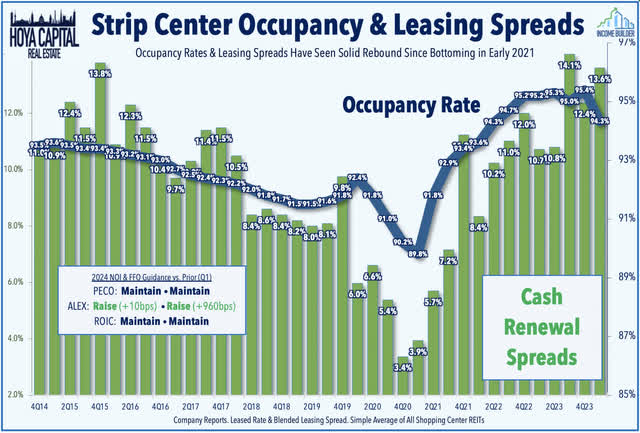

Strip Heart: The preliminary trio of experiences from retail REITs was “status-quo,” displaying comparatively wholesome fundamentals as retailer openings proceed to outpace retailer closings. West Coast-focused Retail Alternative (ROIC) was little-changed after reporting stable leasing exercise in Q1, signing 383k SF of latest and renewed leases – up from 256k in This autumn – and reaching blended lease spreads of seven.2% (new lease spreads of +12.2% and renewals of +6.7%). Regardless of the robust leasing exercise, portfolio leased occupancy dipped 130 bps sequentially to 96.5% because of the vacancies of 4 anchor leases, for which ROIC was capable of safe new tenants, noting that rents on this area “can be greater than double the earlier blended lease.” ROIC reiterated its full-year FFO outlook – implying flat progress from 2023 – and didn’t replace its prior same-store NOI outlook of 1.5%. Phillips Edison (PECO) was additionally little-changed after reporting related developments and sustaining its full-year FFO and NOI outlook. PECO signed 1.3M SF of leases in Q1 and achieved blended spreads of 12.9% – every a slight acceleration from the prior quarter, commenting that it “continues to see excessive retailer demand with no indicators of slowing down.” Hawaii-focused Alexander & Baldwin (ALEX) gained 0.5% after it lifted its same-store NOI outlook and considerably raised its full-year FFO steerage, pushed primarily by non-core land gross sales as a part of its ongoing “simplification.”

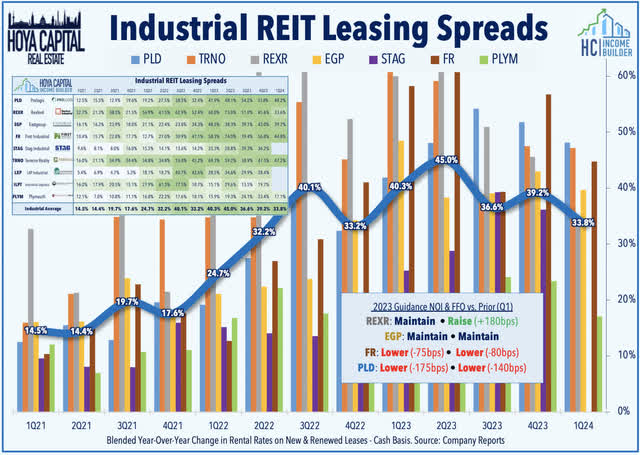

Industrial: The tough quarter for industrial REITs continued this week. EastGroup (EGP) slumped 2% after reporting blended outcomes and an identical moderation in logistics fundamentals because the trio of commercial REIT friends reported final week. EGP echoed commentary from its friends, noting that the “continued financial uncertainty is creating a number of outcomes, comparable to longer leasing deliberations amongst our prospects and a number of consecutive quarters of considerably declining market building begins.” EGP reported Q1 working metrics that had been under consensus estimates however reiterated its full-year outlook, which requires FFO progress of 6.2% and same-store NOI progress of 6.0%. Leasing volumes remained stable at 2.0M SF signed throughout Q1, however blended leasing spreads cooled to +39.7% in Q1 from 43.0% in This autumn. Occupancy metrics additionally softened in Q1 to 97.5% – down 90 bps from This autumn – with explicit weak point seen in its California and Florida markets. EGP highlighted that these occupancy ranges and lease spreads would have been extremely spectacular within the pre-pandemic interval, however “it isn’t a lot enjoyable competing towards the file” comparable efficiency metrics reported in 2023.

Manufactured Housing: Among the many most rate-sensitive REITs, Fairness LifeStyle (ELS) slumped 3% regardless of reporting comparatively robust outcomes and elevating its full-year outlook for each same-store NOI progress and FFO progress. Fueled by elevated income progress expectations in its core manufactured housing section (6.1% vs. 6.0% prior) and a extra modest expense progress forecast (4.7% vs. 5.0% prior), ELS now expects FFO progress of 5.1% this yr, up 40 foundation factors from its prior forecast. In step with the developments over the previous yr, the RV division – particularly the transient and seasonal segments – remained headwinds in the course of the quarter, as RV utilization continues to reasonable following an unbelievable pandemic-era surge. Encouragingly, core transient RV income did lastly return to optimistic territory – rising 1.4% in Q1 in comparison with the -9.4% decline in This autumn – however ELS nonetheless trimmed its full-year RV income progress forecast to five.0% from 5.4%. The core manufactured housing portfolio continues to outperform, with ELS recording a 6.3% improve in month-to-month base rents at $847, whereas its occupancy charge remained flat from final yr at 94.9%. Importantly, ELS reported that its insurance coverage renewals resulted in a 9% improve in premiums for the approaching yr – a far, much more manageable improve in comparison with the 48% surge within the prior yr.

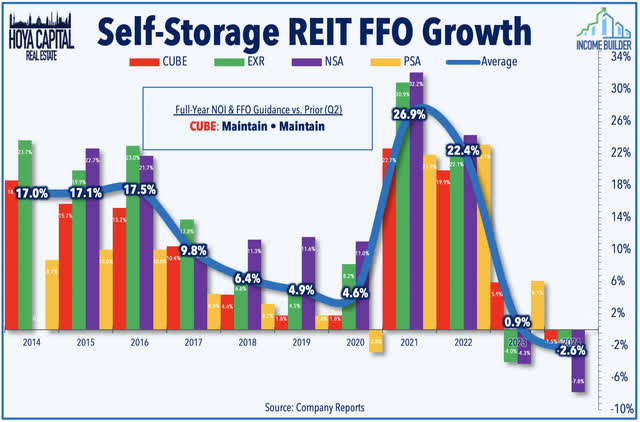

Storage: Additionally among the many laggards this week, CubeSmart (CUBE) slumped 3% after it kicked-off storage REIT earnings season with a blended report displaying continued softness in storage fundamentals because of muted housing market exercise and file ranges of latest provide progress. CUBE reiterated its full-year outlook throughout its property-level and corporate-level metrics, which requires a -2.0% decline in same-store NOI and a -1.5% decline in FFO. We noticed indicators of a rebound in storage demand in late 2023 and early 2024, however the retrenchment in housing market exercise ensuing from the resurgence in mortgage charges led to a disappointing begin to the height leasing season. Interval-end occupancy charges elevated by simply 10 foundation factors sequentially from This autumn to 90.4%, far under the standard seasonal uptick of round 100 foundation factors. Sticky renewal charges on current prospects have helped to maintain blended lease progress marginally optimistic, nonetheless, with CUBE recording a 1.3% year-over-year improve in realized lease per sq. foot regardless of a -13% decline in “avenue charges” (successfully new lease spreads) in Q1 – the sixth straight quarter of double-digit declines in avenue charges.

Mall: Additionally of word this week, struggling clothes retailer Specific, Inc. (EXPR) filed for Chapter 11 chapter safety on Monday and introduced that it could be searching for to vacate a minimum of 100 of its roughly 600 retail shops starting this week – the vast majority of that are in regional mall areas. Specific – which additionally owns the Bonbons and UpWest manufacturers – stated it plans to shut 95 of its Specific shops and all 10 of its UpWest shops however will conduct enterprise as common in its remaining areas. Simon Property (SPG) is reportedly a part of an investor group that’s keen on shopping for the Specific manufacturers, searching for to duplicate a not too long ago profitable system that it used to avoid wasting Without end 21, Brooks Brothers, and Fortunate Manufacturers, amongst different main mall-based manufacturers that had been on the sting of chapter. The investor group – which signed a nonbinding letter of intent to purchase the Specific model – is led by model administration agency WHP World and consists of Brookfield Properties. After a surge in retail bankruptcies early within the pandemic, closures have been comparatively few and much between over the previous two years, as retailer openings outpaced retailer closings in each 2022 and 2023. Different retailers to announce bankruptcies this yr embrace The Physique Store, 99 Cents Solely, and Joann.

Mortgage REIT Week In Evaluation

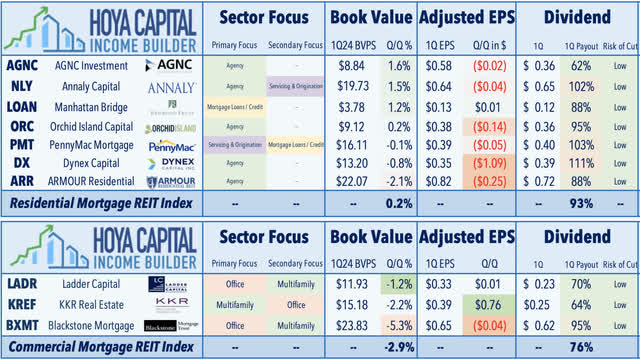

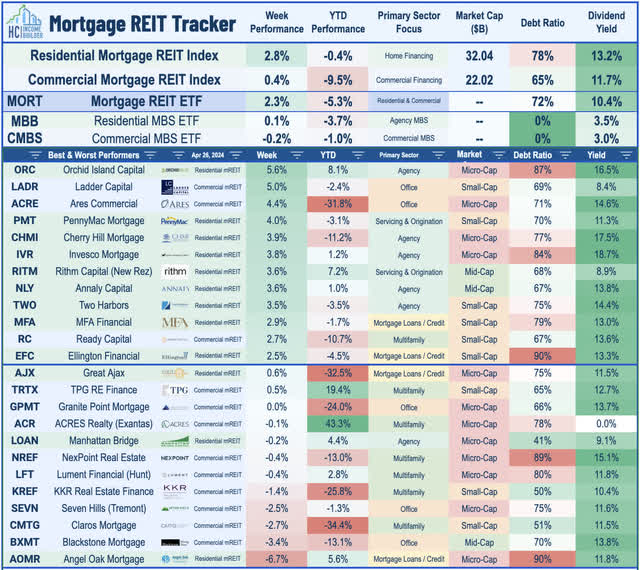

Mortgage REITs delivered notable outperformance over their Fairness REIT friends for a second-straight week – with the iShares Mortgage Actual Property Capped ETF (REM) advancing 2.3% – following a stable begin to mREIT earnings season. Residential mREITs had been the upside standouts, because the preliminary slate of outcomes confirmed that e book values had been comparatively unaffected by the resurgence in rate of interest volatility. Annaly Capital (NLY) – the most important residential mREIT – rallied practically 4% after it reported that its E-book Worth Per Share (“BVPS”) rose 1.5% in the course of the quarter because the affect of upper benchmark treasury yields was offset by a compression in MBS spreads in the course of the first quarter. Encouragingly, NLY famous that regardless of the unfavorable rate of interest dynamics in early Q2, its BVPS was decrease by simply 2-3% up to now this quarter. AGNC Funding (AGNC) – the second-largest residential mREIT – gained 2% this week after related outcomes, noting that its BVPS rose 1.6% in Q1 to $8.84, however famous that its BVPS was down about 8% QTD “on the worst level late final week.” Orchid Island (ORC) rallied practically 6% after reporting that its BVPS elevated by 0.2% in Q1, and was down “about 5%” up to now this quarter. Dynex Capital (DX) – one other agency-focused mREIT – gained 2% on the week after it reported that its BVPS declined 0.8% in Q1 and is down about 7% QTD. PennyMac (PMT) – which focuses on residential credit score and MSRs – rallied 4% after delivering one other stable quarter with little-change in its BVPS.

Earnings outcomes had been shakier on the business mREIT facet, nonetheless, as outcomes confirmed an additional uptick in workplace mortgage misery, but additionally comparatively regular mortgage efficiency throughout non-office-related sectors. Blackstone Mortgage (BXMT) dipped 3% this week after it reported that its distributable EPS dipped to $0.33 in Q1 – down from $0.69 in This autumn – pushed by realized losses ensuing from mortgage resolutions. Whereas multifamily mortgage efficiency remained at 100% in Q1, workplace misery drove a lower in total mortgage efficiency to 92% from 93% final quarter, driving a 5.3% dip in its BVPS. BXMT reiterated assist for its dividend, noting that its EPS ex-charge offs was $0.65/share, which continued to cowl its $0.62/quarter dividend. Elsewhere, KKR Actual Property (KREF) – which was slammed final quarter after reporting weak outcomes – completed decrease by 1% regardless of reporting stronger outcomes, noting that its comparable EPS rebounded to $0.39 in Q1 – up from $-0.37 in This autumn – which lined its recently-reduced dividend of $0.25/quarter. KREF collected 97% of curiosity funds in Q1 – down from 98% – whereas its BVPS declined by 2.2% in Q1. Persevering with to defy the workplace sector headwinds, Ladder Capital (LADR) rallied 5% this week after it reiterated that it has “been pivoting again to offense,” with stable outcomes to again it up. LADR famous that its BVPS was little-changed in Q1 whereas its EPS elevated by a penny to $0.33.

2024 Efficiency Recap

Via seventeen weeks of 2024, actual property equities have considerably lagged behind the broader fairness benchmarks following a robust year-end rebound in 2023. The Fairness REIT Index is decrease by -8.4%, whereas the Mortgage REIT Index is decrease by -5.0%. This compares with the 7.4% acquire on the S&P 500, the 4.6% acquire for the S&P Mid-Cap 400, and the two.2% decline for the S&P Small-Cap 600. Throughout the REIT sector, 5 of the 18 property sectors are increased for the yr, led by Billboard, Single-Household and House REITs – whereas Industrial, Cell Tower, and Storage REITs have lagged on the draw back. At 4.67%, the 10-12 months Treasury Yield is increased by 79 foundation factors on the yr, whereas the 2-12 months Treasury Yield has risen 57 foundation factors to as soon as once more prime 5.0%. Following a late-year rally within the ultimate months of 2023, the Bloomberg US Bond Index is decrease by -3.2% this yr. Behind a lot of the renewed inflation headwinds, WTI Crude Oil is increased by 20.6% this yr, lifting the broader Commodities advanced increased by 7.0%.

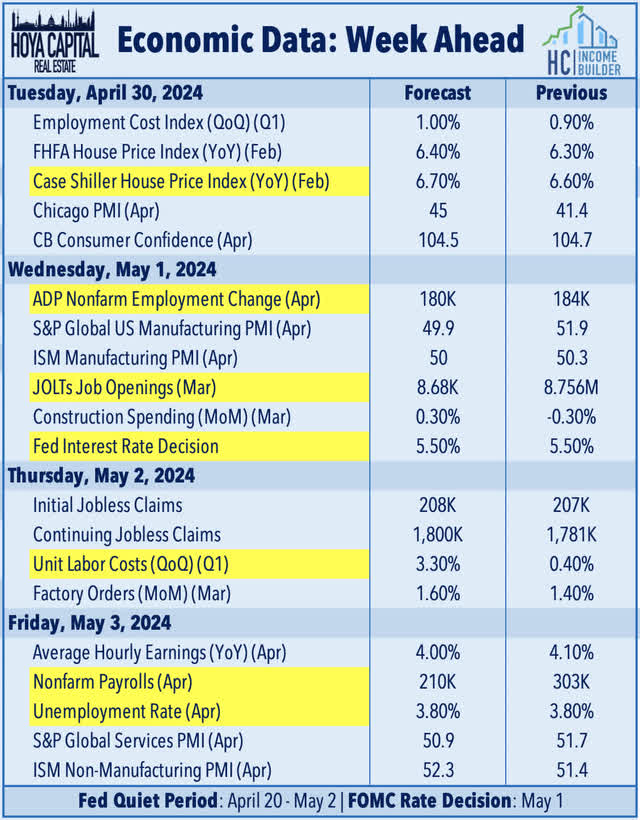

Financial Calendar In The Week Forward

All eyes can be on the Federal Reserve within the week forward. Whereas the FOMC will certainly maintain benchmark rates of interest regular on the present 5.5% higher sure, buyers can be centered on up to date “dot plots” and commentary from Fed Chair Powell for indications on how latest sizzling inflation information has altered their prior median forecast calling for 3 charge cuts this yr. Employment information highlights the essential week of financial information, headlined by the JOLTS report and ADP Payrolls on Wednesday, Jobless Claims information on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are in search of job progress of roughly 210k in April, which follows a really robust report in March during which 310K jobs had been added to the payrolls. The Common Hourly Earnings sequence throughout the BLS payrolls report – which is the primary main inflation print for April – can even be intently watched and is anticipated to indicate wage progress moderating to a 4.0% annual improve from the 4.1% improve reported final month. We’ll additionally see residence value information on Tuesday through the Case Shiller House Value Index and the FHFA House Value Index, which have every proven a moderation in value appreciation from the double-digit will increase in the course of the pandemic to ranges that roughly match nominal GDP progress, in keeping with their long-run correlations. We’ll even be monitoring PMI metrics from S&P World and ISM and the Building Spending report on Wednesday.

For an in-depth evaluation of all actual property sectors, take a look at all of our quarterly experiences: Residences, Homebuilders, Manufactured Housing, Pupil Housing, Single-Household Leases, Cell Towers, Casinos, Industrial, Knowledge Heart, Malls, Healthcare, Web Lease, Purchasing Facilities, Resorts, Billboards, Workplace, Farmland, Storage, Timber, Mortgage, and Hashish.

Disclosure: Hoya Capital Actual Property advises two Trade-Traded Funds listed on the NYSE. Along with any lengthy positions listed under, Hoya Capital is lengthy all elements within the Hoya Capital Housing 100 Index and within the Hoya Capital Excessive Dividend Yield Index. Index definitions and a whole record of holdings can be found on our web site.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.