Pgiam

Actual Property Weekly Outlook

U.S. fairness markets rallied to contemporary record-highs this week whereas rates of interest remained close to three-month highs after earnings outcomes from mega-cap tech companies rekindled an AI-fueled rally, offsetting “excessive for longer” considerations that continued to weigh on rate-sensitive segments of the economic system. This “story of two economies” was exhibited vividly throughout earnings stories this week, which confirmed notable outperformance from high-margin services-oriented segments – tech, leisure, and promoting – and stunning weak point from many goods-oriented and capital-intensive segments – farmland, workplace, and chilly storage.

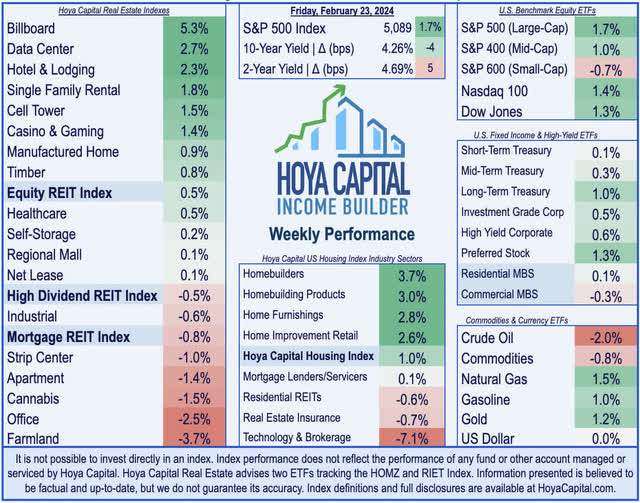

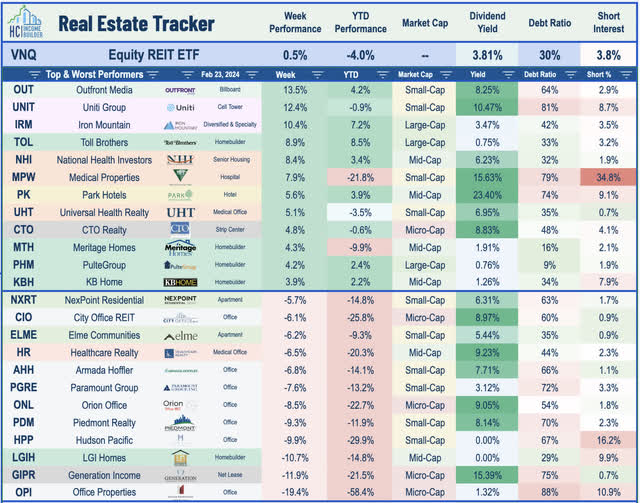

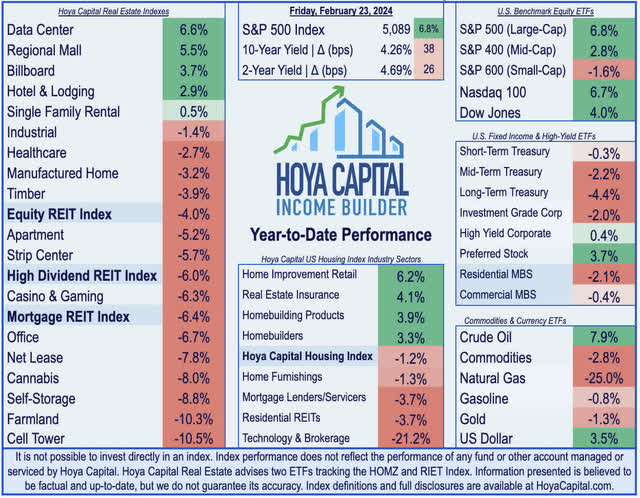

After snapping a five-week profitable streak within the prior week, the S&P 500 rebounded 1.7% this week, lifting the large-cap benchmark to all-time highs. In step with the prevailing theme all through the Federal Reserve’s price tightening cycle over the previous two years, the good points this week had been notably top-heavy. Sturdy earnings outcomes from chipmaker Nvidia (NVDA) lifted the mega-cap Nasdaq 100 to good points of 1.5%, whereas the Small-Cap 600 completed decrease by practically 1% on the week. Remarkably, the Nasdaq prolonged its 52-week outperformance over the small-cap index to 45 share factors, the widest dispersion because the “dot-com” surge in 1999. Actual property equities had been combined this week as earnings stories confirmed power from some economically-sensitive property sectors, but in addition some weak point and outright misery in some corners of the most-rate-sensitive property sectors. The Fairness REIT Index completed increased by 0.5% on the week, with 12-of-18 property sectors in optimistic territory, however the Mortgage REIT Index declined 0.8%.

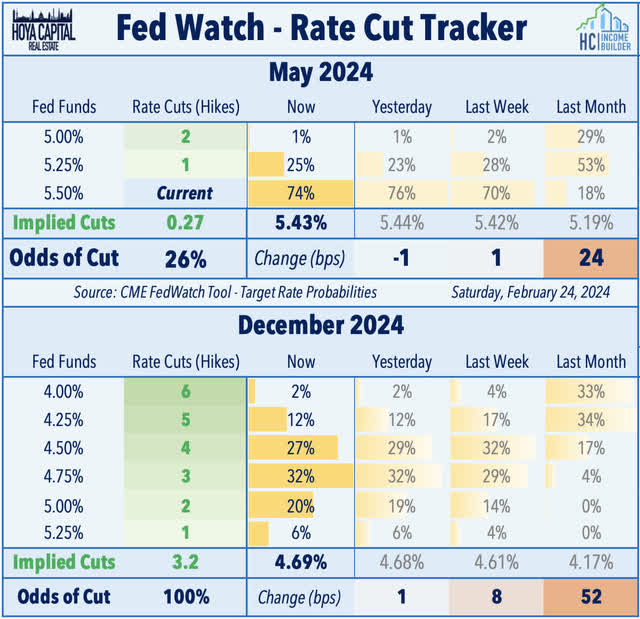

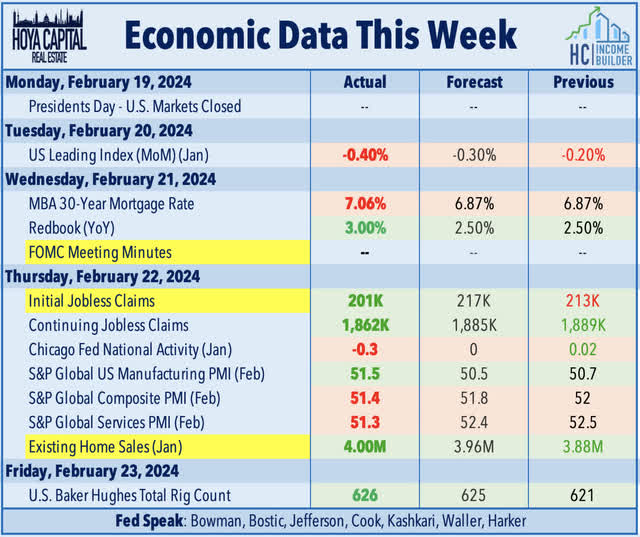

Following a surge to three-month highs within the prior week on the heels of hotter-than-expected inflation knowledge, benchmark rates of interest declined on the long-end of the curve this week, however continued climbing on the short-end after minutes from the Federal Reserve’s January assembly confirmed little urgency to chop charges. Swaps markets are actually pricing in simply 3 price cuts this 12 months – which now matches the midpoint of the Federal Reserve’s “dot plot” – with the primary minimize not totally priced in till June. Markets had priced in as many as 7 price cuts earlier this 12 months and, on the time, pegged practically 80% odds that cuts would start by March. The 10-Yr Treasury Yield retreated by 4 foundation factors this week to 4.26%, whereas the policy-sensitive 2-Yr Treasury Yield climbed to 4.69% – the best since early December. After hitting its highest-level since November final week, Crude Oil costs retreated by 2% this week.

Actual Property Financial Information

Beneath, we recap an important macroeconomic knowledge factors over this previous week affecting the residential and industrial actual property market.

Fairness REIT & Homebuilder Week In Assessment

Greatest & Worst Efficiency This Week Throughout the REIT Sector

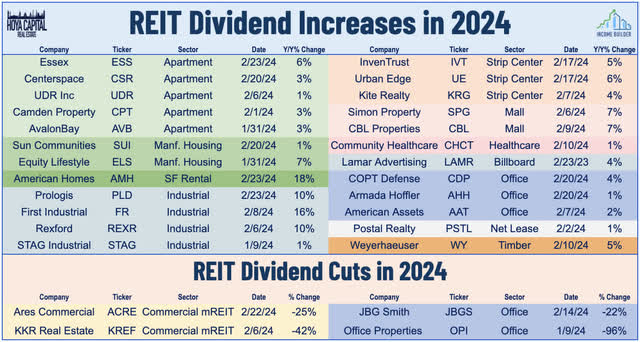

We entered the house stretch of REIT earnings season this week, with stories from three dozen fairness and mortgage REITs. We have now seen outcomes from 75% of the sector, and stories over the previous week usually continued the optimistic tendencies seen within the first-half of earnings season, with notably strong stories from a number of of essentially the most beaten-down names within the house. Of the 70 fairness REITs that present full-year Funds From Operations (“FFO”) steerage, 47 REITs (67%) beat the midpoint of their forecast, 17 REITs (25%) matched, whereas simply 6 REITs (9%) missed estimates. This 67% FFO “beat price” is working forward of the historic REIT sector common in This fall of roughly 65%, and forward of the 55% at this level of earnings season final 12 months. Whereas a dividend minimize from industrial lender Ares Industrial (ACRE) fueled one other wave of downbeat press commentary centered on “CRE misery,” this weak point has remained the exception and never the rule amongst public REITs. Positively, eight extra REITs raised their dividend this previous week, together with 4 residential REITs: American Houses (AMH) hiked by 18%, Essex (ESS) hiked by 6%, Centerspace (CSR) by 3%, and Solar Communities (SUI) by 1%; two workplace REITs: COPT Protection (CDP) hiked by 4%, and Armada Hoffler (AHH) by 1%; one industrial REIT: Prologis (PLD) hiked by 10%; and one specialty REIT: Lamar Promoting (LAMR) hiked by 4%. We have seen 19 REITs announce dividend hikes this 12 months, whereas 4 REITs have lowered their dividends.

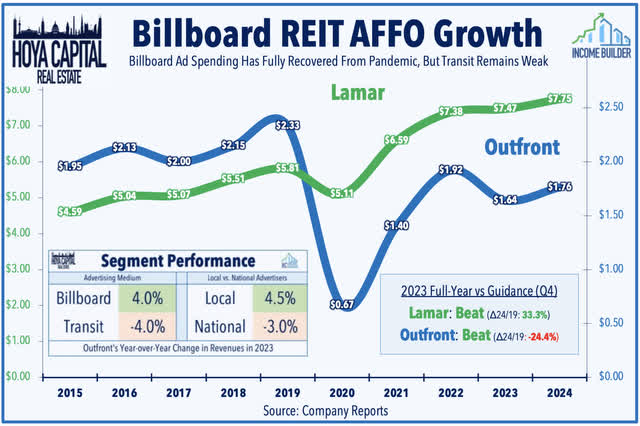

Billboard: Starting with upside standouts, the 2 billboard REITs posted sturdy good points this week after outcomes confirmed wholesome “Out of Residence” promoting spending tendencies in late 2023 and into early 2024. Outfront Media (OUT) – which endured a punishing sell-off of 70% between mid-2022 and late 2023 – soared 13% after reporting encouraging outcomes, as continued power from its core billboard phase offset lingering headwinds on its pandemic-disrupted transit phase and considerations about its debt-heavy steadiness sheet. OUT famous that billboard revenues rose 4% for the 12 months, “pushed by increased charges ensuing from sturdy demand,” whereas revenues in its transit phase – which incorporates its troubled MTA franchise – declined 4% for the 12 months to ranges that stay roughly 35% beneath 2019-levels. These strong property-level fundamentals helped to partially offset a surge in curiosity expense. OUT recorded a -14.5% dip in its full-year FFO in 2023 – not as weak as feared – and sees a return to development in 2024, projecting FFO development within the “excessive single-digits.” Its bigger peer, Lamar – which has benefited from its restricted transit publicity and its stronger steadiness sheet – gained 3% after reporting equally strong outcomes, recording full-year FFO development of 1.2% in 2023 and projecting development of three.7% in 2024, which might be a powerful 33% above its 2019-level. Each REITs reported stronger local-based promoting spending, which grew roughly 4% year-over-year, whereas nationwide model spending declined by 3%.

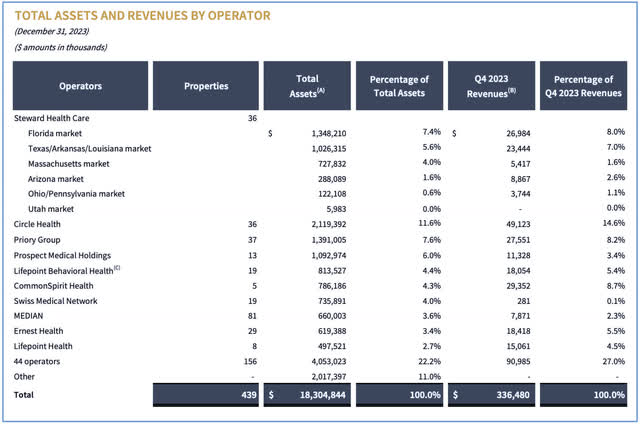

Healthcare: Probably the most closely-watched stories this earnings season, embattled hospital proprietor Medical Properties Belief (MPW) – which has plunged over 70% because the begin of 2022 – rebounded 8% this week after its outcomes had been much less catastrophic than feared. Again in January, MPW reported that its largest tenant, Steward Healthcare – representing 1 / 4 of MPW’s annual revenues, did not pay 75% of its hire in This fall regardless of efforts by MPW to prop up the struggling operator by way of extra bridge loans and hire abatement. Following the “bombshells” in January, the earnings report this week was more-or-less “establishment,” with MPW reiterating its plan to cut back its Steward publicity and successfully writing off a large chunk of the Steward portfolio by way of a $770M impairment, as anticipated, and transferring these property to a cash-basis accounting format. Situations seem to have improved considerably for MPW’s different struggling operator – Prospect – which paid all hire and curiosity due by means of January. MPW finally reported that its full-year normalized FFO declined -12.6% in 2023 – barely higher than its prior steerage of a -13.7% decline. Relating to its dividend – which was already slashed by 50% final 12 months – MPW commented that it is “not depending on Steward, [but rather] our skill to shut a few of these liquidity transactions.” Elsewhere within the healthcare house, Nationwide Well being Traders (NHI) rallied 8% after its outcomes confirmed continued enchancment in hire protection from its senior housing and expert nursing operators. As with its SH-focused friends, NHI’s senior housing working portfolio stays a notable bright-spot, pushed by bettering occupancy charges and mid-single-digit hire development.

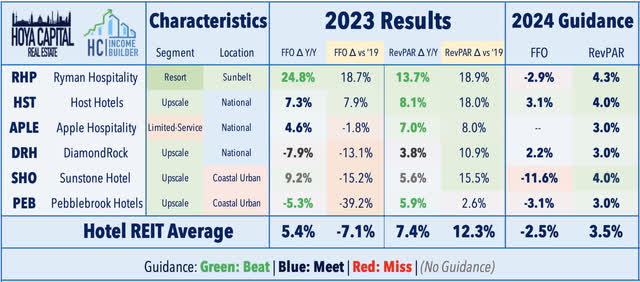

Resorts: Additionally among the many top-performers this week, the lodge sector was broadly increased as outcomes from the preliminary slate of six lodge REITs confirmed that leisure demand tendencies remained spectacular in late 2023 and into early 2024. Host Resorts (HST) – the biggest lodge REIT – superior 3% after reporting that its Income Per Out there Room (“RevPAR”) rose 8.1% in the course of the 12 months, which was 18% above 2019 ranges. Host sees a “secure working atmosphere” in 2024 with forecasted RevPAR development of 4%, ensuing from “continued enchancment in group enterprise, a gradual restoration in enterprise transient, and regular leisure demand.” HST recorded full-year FFO development of seven.3% in 2023 – roughly matching its prior outlook – and sees FFO development of three.1% in 2024. Sunbelt-focused Ryman Hospitality (RHP) – which has posted the strongest working tendencies all through the pandemic – gained 2.5% this week after it posted double-digit FFO and RevPAR development in 2023, every to ranges which are roughly 20% above the 2019 comparable. Apple Hospitality (APLE) has additionally been a pandemic-era outperformer, gaining 2% this week after posting one other strong quarter, exhibiting regular tendencies within the limited-service phase. Pebblebrook (PEB) was a laggard after its outcomes confirmed that the post-pandemic restoration stays incomplete within the business-travel-dependent coastal city segments. PEB reported that its FFO remained practically 40% beneath 2019-levels in 2023, whereas its RevPAR lastly recovered to pre-pandemic ranges – far beneath the 12% common improve from the steadiness of the sector.

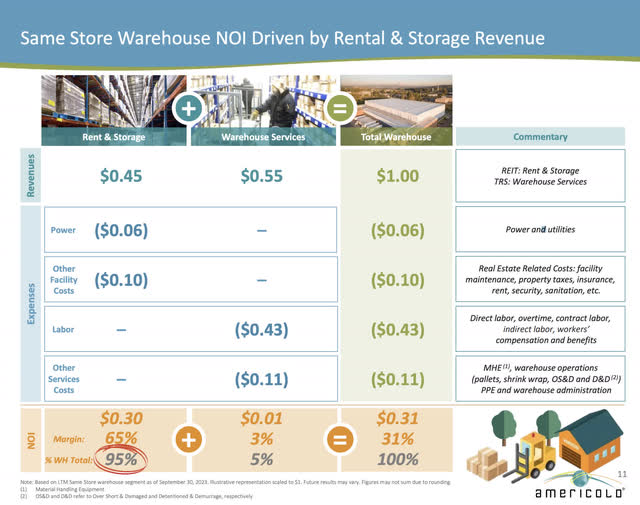

Industrial: Onto some draw back surprises, chilly storage operator Americold (COLD) dipped 5% this week after its outcomes confirmed stunning weak point in shopper spending on refrigerated meals merchandise in late 2023 and into early 2024 – particularly in its European markets – and flagging a “massive swing within the economic system” which led to a 7.6 percentage-point drop in throughput volumes in This fall versus the prior 12 months. Underscoring the more-services-oriented nature of chilly storage operations in comparison with conventional industrial actual property, the frustration in This fall was completely attributable to its weak point in its lower-margin warehouse providers phase. Whereas COLD’s actual property phase (“international warehouse hire and storage”) posted a powerful 15.4% improve in complete NOI for 2023 pushed by record-high occupancy charges and robust pricing energy, COLD’s service phase (“international warehouse providers”) posted a 33% dip in complete NOI in 2023. COLD’s outlook indicated that these combined tendencies will proceed this 12 months, cautioning that the providers phase will see weaker efficiency within the first-half of 2024 in comparison with the already-soft This fall “given the continued declining throughput quantity assumptions.”

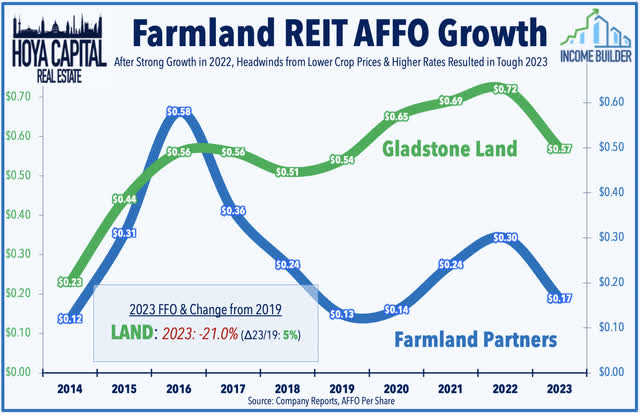

Farmland: Sluggish tendencies on the “items” aspect of the economic system had been additionally obvious within the tender outcomes from Gladstone Land (LAND), which declined 3.5% on the week after reporting an uptick in emptiness charges and hire assortment problem from a number of extra farmer tenants, which have been pressured by a “triple whammy” of decrease crop costs, decrease crop yields, and better rates of interest. LAND reported that its 12 months FFO dipped -21% in 2023 – backtracking a lot of the pandemic-era development – and famous that it now has vacancies at 15 of its 168 farms, up from the low-single-digits in 2021 and 2022. LAND famous that these headwinds have pressured farmland valuations in current quarters following a robust run-up in the course of the pandemic, offering an estimated Web Asset Worth of $19.06 at year-end – down about 6% in the course of the quarter – as a consequence of a mixture of decrease property value determinations and a better honest worth of its liabilities. Positively, the once-dire water constraints in California have eased after a multi-year drought, however this enchancment comes after LAND invested closely in water sources within the area lately. LAND didn’t present formal steerage, however did notice that tenant points stay remoted to a handful of operators, and famous that acquisition exercise is predicted to stay muted for the foreseeable future given the excessive price of capital and land costs that “are nonetheless too excessive to make sense.”

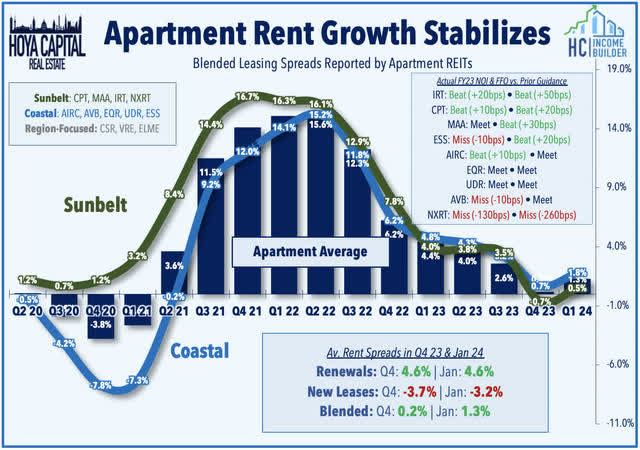

Condominium: Sunbelt-focused NexPoint Residential (NXRT) was among the many laggards this week after reporting combined fourth-quarter outcomes, as comparatively sturdy property-level efficiency was offset by a leap in rate of interest expense ensuing from its elevated debt load in comparison with its REIT friends. NXRT reported that its Core FFO dipped -10.5% in 2023 – beneath its prior steerage of -8.0% – and expects its FFO to say no -2.9% for full-year 2024 on the midpoint of its preliminary steerage vary. NXRT paid practically $17M in incremental curiosity expense in 2023 (+32% from final 12 months) ensuing from its variable price mortgage debt, which resulted in a roughly 25 percentage-point drag to its Core FFO. Property-level efficiency was actually not the difficulty, as NXRT reported sector-leading NOI development of 8.2% in 2023, as strong income development of seven.1% was partially offset by a 5.5% improve in bills. As with its house friends, NXRT sees flat-to-negative hire development in 2024, mirrored in its full-year outlook for flat NOI development – roughly in-line with its Sunbelt-focused friends. Coastal-focused REITs count on barely extra buoyant tendencies in 2024, with a median NOI outlook calling for 1.5% development this 12 months.

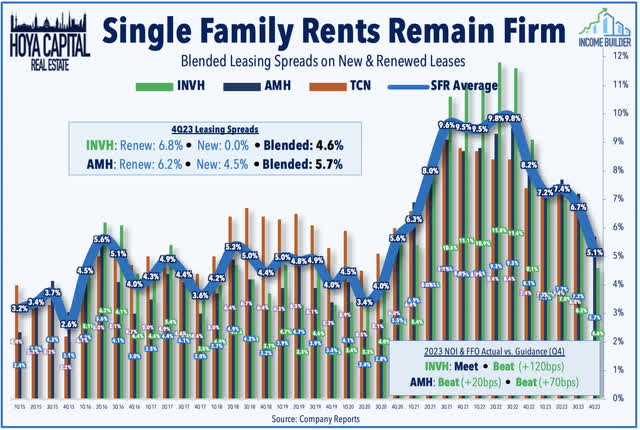

Single-Household Rental: Whereas outcomes from multifamily REITs have been less-than-impressive this earnings season, stories from SFR and manufactured housing REITs have proven that hire development tendencies have remained buoyant on the single-family aspect. American Houses (AMH) gained 2.5% this week after reporting very strong outcomes, together with spectacular full-year FFO development of seven.8% in 2023 – above its prior forecast – and tasks FFO development of 4.2% in 2024. Hire development tendencies had been notably spectacular – and notably stronger than its peer Invitation Houses (INVH), which reported final week. AMH recorded blended hire development of 5.7% in This fall (+6.2% renew, 4.5% new), whereas blended spreads held agency into January at 5.3% (+5.7% renew, 4.3% new). The earnings name was centered largely on macro SFR fundamentals and AMH’s outlook on exterior development. AMH conceded that “acquisition and capital market environments are usually not conducive to accretive development” by way of conventional acquisition channels, however it continues to lean closely into its inside Construct To Hire (“BTR”) program, which was liable for the overwhelming majority of its complete portfolio development in 2023. AMH’s macro outlook on SFR fundamentals remained very upbeat, pushing again on concern over an uptick in SFR provide in a number of markets (Vegas and Phoenix), and offering steerage calling for 96% occupancy price and 4.0% same-store NOI development in 2024.

Manufactured Housing: Sticking with that theme, Solar Communities (SUI) – the biggest manufactured housing REIT – superior 1% this week after it reported very sturdy U.S. property-level efficiency in This fall and supplied steerage exhibiting a return to FFO development in 2024 alongside a 1% dividend hike, which helped to offset continued weak point in its struggling UK phase. SUI reported that its full-year Core FFO declined -3.4% in 2023 – barely higher than its prior steerage – and sees a return to development in 2024 with anticipated FFO development of 0.6%. Property-level efficiency within the U.S. was very sturdy within the remaining months of 2023, as headwinds from its sluggish transient RV phase lastly started to reasonable. For full-year 2023, SUI reported segment-level NOI development of 6.8% for Manufactured Housing, 4.8% development for RVs, and 11.7% development for Marina – all of which exceeded its prior steerage. Its ill-timed worldwide growth into the UK in 2022 continues to current complications for the corporate, nonetheless, as SUI wrote-off one other $370M in its Park Holidays funding and famous that its collateral backing a separate £337M mortgage was valued beneath principal. In the end, its UK division recorded a complete NOI that was 55% beneath SUI’s preliminary outlook for the 12 months.

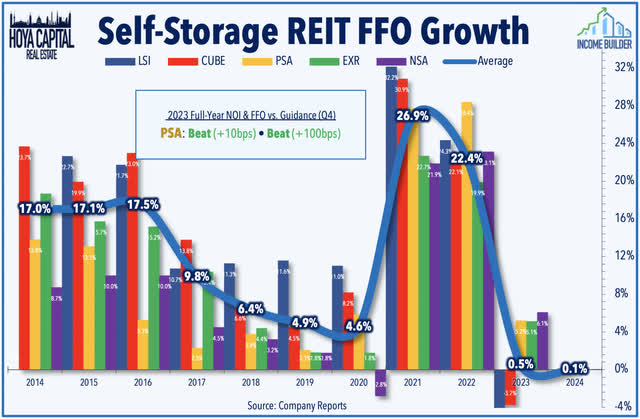

Storage: Public Storage (PSA) gained 1% this week after it kicked off storage earnings season with an honest report exhibiting some stabilization in “road charges” (new lease charges) in current months following a steep deceleration all through 2023. PSA reported full-year FFO development of 6.1% in 2023 – above its prior forecast of 5.1% – and sees marginally optimistic development of 0.1% in 2024. On the property-level, PSA recorded full-year NOI development of 4.1% in 2023 – additionally barely exceeding its prior outlook – however expects a -0.9% decline in 2023 as comparatively buoyant hire development on current prospects continues to be offset by materially decrease lease charges for brand spanking new prospects. The corporate conceded that “the brand new buyer atmosphere stays difficult” however highlighted some enhancements in current months, with road charges decrease by -10% in January and February, an enchancment from the -18% dip in This fall.

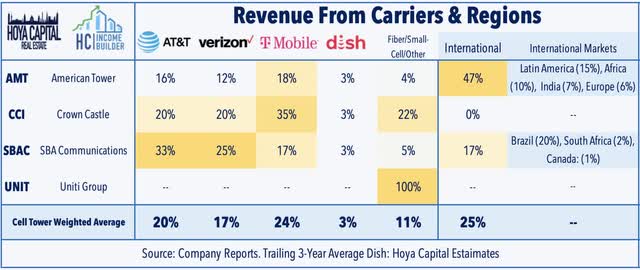

Cell Tower: Whereas not earnings-related, Crown Citadel (CCI) was in focus this week amid an escalating proxy battle forward of a board nomination deadline on Saturday. Separate from the continued proxy battle waged by activist investor Elliott Investor Administration – which has gathered a $2B stake within the firm over the previous a number of years – CCI’s former CEO Ted Miller printed a letter outlining its personal plan for a strategic overhaul, which would come with having Miller re-assume a management function alongside three different proposed administrators. Miller co-founded CCI in 1994 and was CEO from 1996 to 2001, and his agency Boots Capital disclosed a roughly $100M stake within the firm. Just like Elliott’s proposals, Miller urged CCI to promote its fiber enterprise and pulled no punches in its critique of the present administration, remarking, “Crown Citadel have to be rebooted after the shameful journey into fiber, which has price buyers tens of billions and turned the worldwide industry-leader right into a ridiculed laggard.” CCI derives roughly 1 / 4 of its income from fiber and small cell operations, and these segments would fetch an estimated $11-15B in a possible sale. Crown Citadel introduced that its board rejected the nominations “after cautious consideration” and reiterated that its strategic and working evaluation of its fiber enterprise and parallel CEO search is ongoing.

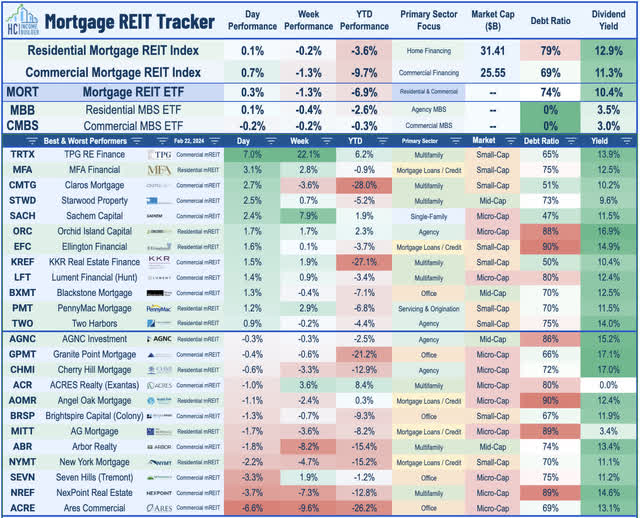

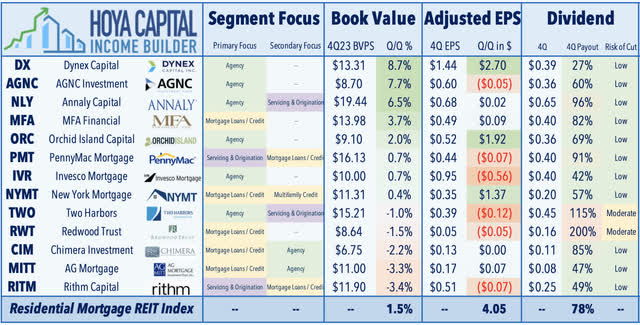

Mortgage REIT Week In Assessment

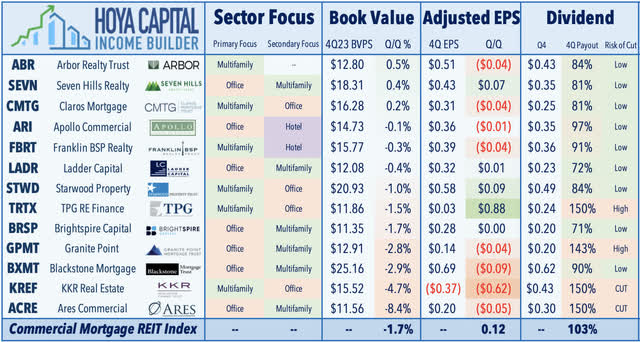

Mortgage REITs traded modestly increased this week as buyers parsed a busy slate of earnings outcomes exhibiting that some lenders have been extra profitable than others in managing the uptick in mortgage delinquencies. On the draw back, Ares Industrial (ACRE) – the mREIT with the best stage of workplace publicity – dipped 7% this week after reporting weak outcomes and lowering its dividend by 25%, pressured by an uptick in workplace delinquency charges. ACRE reported that its Ebook Worth Per Share (“BVPS”) dipped by a sector-worst -8.4% in This fall, pushed by a big improve in its CECL reserve to replicate increased loss estimates for a number of workplace and residential building loans. ACRE notes that it had $539M in loans rated Danger 4 or 5 – the best danger ranges – up from $478M final quarter. ACRE’s distributable EPS dipped to $0.20 in This fall – down from $0.25 in Q3 – and failing to cowl its prior $0.30/share dividend. Subsequently, ACRE decreased its dividend to $0.25/share for Q1, which displays its “go-forward view of close to time period quarterly run-rate Distributable Earnings.” Additionally, a laggard this week, Claros Mortgage (CMTG) dipped 8% after reporting that its EPS declined to $0.31 in This fall from $0.35 final quarter, ensuing primarily from a default on a California multifamily mortgage, together with a downgrade of 5 extra loans into the “excessive danger” bucket.

On the upside this week, TPG RE Finance (TRTX) surged greater than 20% this week after it reported that it took “decisive” steps in This fall to handle its delinquent loans, leading to a e-book that was 100% performing by quarter-end. TRTX reported that its BVPS declined a modest 1.5% in This fall to $11.86 and reported EPS of $0.03 – up from a lack of -$0.85 in Q3. TRTX resolved practically $500M in delinquent loans in the course of the quarter – recognizing $184M in realized losses within the course of, however its CECL reserve successfully coated all of those eventual losses. Starwood Property (STWD) additionally reported comparatively regular mortgage efficiency, gaining 0.5% this week after reporting a modest 1% decline in its Ebook Worth in This fall, whereas its distributable EPS rose to $0.58 – up from $0.49 final quarter – which simply coated its $0.49/share dividend. STWD famous that its common danger ranking was unchanged in This fall, as downgrades to $502M in loans had been offset by upgrades to $197M in loans. Relating to its dividend, STWD famous that it feels “very comfy that our dividend might be safe for the foreseeable future.” Seven Hills (SEVN) rallied 7% after it reported equally encouraging outcomes, noting that its BVPS rose 0.4% in This fall to $18.31 and reported EPS of $0.43 – up from $0.36 final quarter – which coated its $0.35/share dividend. BrightSpire (BRSP) gained 1% after it reported that its BVPS declined 1.7% in This fall to $11.35 whereas its distributable EPS was $0.28 – flat from final quarter and overlaying its $.20/share dividend.

On the residential aspect, MFA Monetary (MFA) was an upside standout, gaining 2.5% this week after reporting very strong outcomes, noting that its BVPS elevated 3.7% in the course of the quarter – the fourth-best up to now throughout the two-dozen mREITs this earnings season. MFA additionally reported an increase in its distributable EPS to $0.49 – up from $0.40 – which coated its $0.40/share dividend. AG Mortgage (MITT) gained 3% after it reported that its comparable EPS improved to $0.17 in Q3 – barely shy of its $0.18/share dividend – however expressed confidence in its protection in 2024 following its now-closed acquisition of Western Asset Mortgage, noting that “all onetime transaction bills are behind us… and for the present dividend run price, we’ll now have the total advantages of the G&A scale we achieved within the acquisition.” On the draw back this week, Redwood Belief (RWT) dipped 8% after reporting that its BVPS declined 1.5% in This fall and reported distributable EPS of $0.05 – down from $0.10 final quarter and shy of its $0.16/share dividend. Regardless of the protection shortfall, RWT famous in its name that it “very a lot sees a path in the direction of overlaying the dividend.” New York Mortgage (NYMT) slipped 3% after reporting combined outcomes, noting that its BVPS was roughly flat in This fall – a disappointment after the sharp dip in Q3 – however did see its distributable EPS swing again into optimistic territory. With about 75% of mREIT earnings season full, residential mREITs have reported a median BVPS achieve of two.0% in This fall, whereas industrial mREITs have reported a median 1.2% decline.

2024 Efficiency Recap & 2023 Assessment

By eight weeks of 2024, actual property equities have lagged the broader fairness benchmarks following a robust year-end rebound in 2023. The Fairness REIT Index is decrease by -4.0%, whereas the Mortgage REIT Index is decrease by -6.4%. This compares with the 6.8% achieve on the S&P 500, the two.8% achieve for the S&P Mid-Cap 400, and the -1.6% decline for the S&P Small-Cap 600. Inside the REIT sector, 5 of the 18 property sectors are increased for the 12 months, led on the upside by Information Heart, Regional Mall, Billboard, and Resort REITs, whereas Cell Tower and Farmland REITs have lagged on the draw back. At 4.26%, the 10-Yr Treasury Yield is increased by 38 foundation factors on the 12 months, whereas the 2-Yr Treasury Yield has risen 26 foundation factors to 4.64%. Following a late-year rally within the remaining months of 2023, the Bloomberg US Bond Index is decrease by -1.8% this 12 months. WTI Crude Oil is increased by 7.9% this 12 months, however the broader Commodities advanced stays decrease by -2.8% on the 12 months.

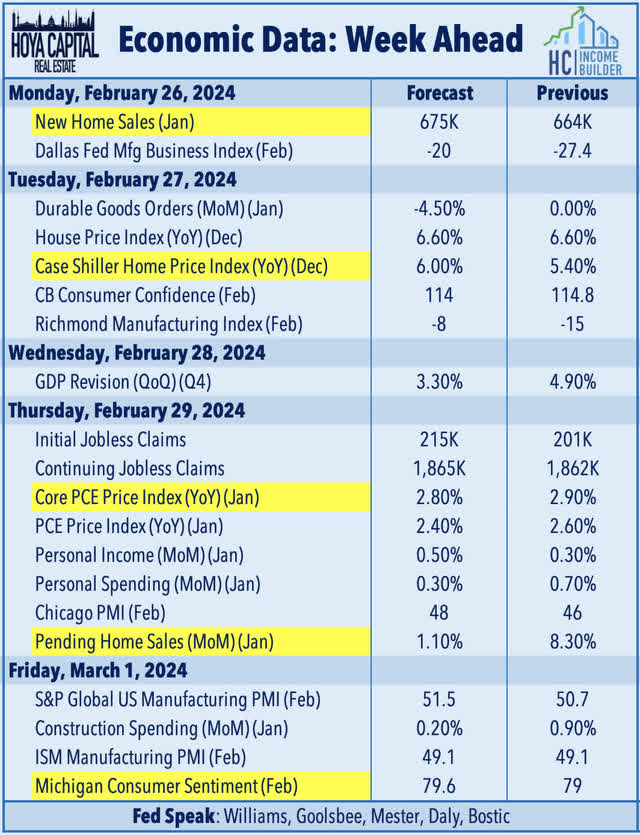

Financial Calendar In The Week Forward

Following a quiet week of financial knowledge, we’ll see a jam-packed slate of information within the week forward. Essentially the most closely-watched report of the week would be the PCE Worth Index on Thursday – the Fed’s most well-liked gauge of inflation – which is predicted to point out an annual improve of simply 2.4% on the Headline price – down sharply from the 7.1% peak in mid-2022. Core PCE is predicted to chill to 2.8% in January, down from its peak of 5.6%. On the inflation-front, we’ll even be watching revisions to fourth-quarter Gross Home Product, which confirmed an encouraging moderation in value pressures within the preliminary studying final month. We’ll see a busy slate of housing market knowledge all through the week as nicely. On Monday, New Residence Gross sales knowledge for January is predicted to point out a modest acceleration to a 675k annualized price, as the biggest builders have been ready to deal with multi-decade-high mortgage charges by providing extra engaging financing choices than what’s presently out there for homebuyers within the current dwelling gross sales market. We’ll see dwelling value knowledge on Tuesday by way of the Case Shiller Residence Worth Index and the FHFA Residence Worth Index, which have every proven a moderation in value appreciation and pockets of adverse appreciation in some oversupplied markets, however not the outright national-level value declines that some pundits forecasted. We’ll even be watching Pending Residence Gross sales and Jobless Claims knowledge on Thursday and a full slate of enterprise and shopper surveys, together with ISM and S&P Manufacturing PMI and Michigan Shopper Sentiment on Friday.

For an in-depth evaluation of all actual property sectors, try all of our quarterly stories: Residences, Homebuilders, Manufactured Housing, Pupil Housing, Single-Household Leases, Cell Towers, Casinos, Industrial, Information Heart, Malls, Healthcare, Web Lease, Procuring Facilities, Resorts, Billboards, Workplace, Farmland, Storage, Timber, Mortgage, and Hashish.

Disclosure: Hoya Capital Actual Property advises two Trade-Traded Funds listed on the NYSE. Along with any lengthy positions listed beneath, Hoya Capital is lengthy all elements within the Hoya Capital Housing 100 Index and within the Hoya Capital Excessive Dividend Yield Index. Index definitions and an entire checklist of holdings can be found on our web site.